Biting Commentary

Executive Pay Give-Backs: Justifiable Retribution or Penis Envy?

By Richard B. Barger, ABC, APR

Originally Posted

Updated

-

Adelphia

-

Aquila

-

Arthur Andersen

-

Bristol Myers

-

Dollar General

-

Enron

-

Global Crossing

-

ImClone

-

Merck

-

Merrill Lynch

-

Phar-Mor

-

Rite Aid

-

Sunbeam

-

Tyco

-

WorldCom

-

Xerox

It's tip-of-the-iceberg time.

It is all but impossible to accumulate a complete list of the business bankruptcies, accounting irregularities, greedy executives, unfavorable headlines, warnings, rumors, denials, deceptions, and unsavory practices that have permeated big business over the past several months.

The business rumor- or screw-up-of-the-moment screams out from front pages and broadcast teases, as media jump on the bashing bandwagon, hands full with a microphone or notepad, coffin nails, and a hammer, and news executives' ratings and readership demands ringing in their ears.

All the budding Mike Wallaces and Geraldo Riveras seek to vilify ethically challenged executives who have manufactured sales and revenues and pumped up earnings with accounting fraud and other dishonest practices. Desperation? Greed?

Certainly, the terms "stupidity" and "wretched excess" come to mind.

And if it were that simple, I probably would sing the same tune. After all, who gives a damn about big business, when you can feature heart-rending visuals of a 30-year assembly line worker whose retirement funds were wiped out?

Why would I speak up in the face of such obvious egregious acts?

This Piling On Is No Fun

It is mostly my contrarian nature and the fact that I don't like the piling on that's happening. I say that every time our helpful media and politicians all gang up on somebody and do a wink-wink, nudge-nudge nod in the direction of their idea of fairness, there's at least the possibility of something else going on that needs to be looked at. There may actually be another side.

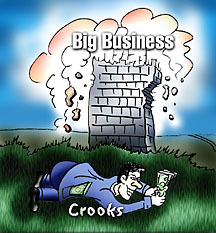

Let's be clear: I offer no support for the crooks.

Let 'em fry.

But I'm unwilling to say everyone is a crook just because that's the popular -- or the easy -- thing to do.

WorldCom's former CEO Bernie Ebbers seems to be a bit over the top, with a $400 million loan from the company, a lifetime severance package of $1.5 million a year, complete medical and life insurance, and access to the corporate jet.

Let's just arbitrarily say the value of all this largess is $425 million. Spread across the 17,000 WorldCom employees who lost their jobs and their retirement funds, the average of $25,000 would be a nice few months' salary for the employees, to be sure, but would make scant difference in any retirement fund pay-out. Do the math. And that doesn't account for third-party retirement fund investments in WorldCom stock, which would dilute Bernie's contribution to everyone.

Retribution, Revenge, Not Reimbursement

Doing the right stuff and keeping the company operating -- that would have been the proper approach. Scavenging the bank account of the head miscreant after he and his henchmen have already brought the company to its belly is an awfully poor substitute. It speaks of retribution and revenge, not reimbursement.

When the unions -- who believe that they should have most of the corporate revenues, not shareholders or those damned executives -- and the Liberals get on their socialism kick, my antenna go up.

These folks would have more credibility -- and, in my mind, more legitimacy -- if they'd pick their battles, rather than taking every event as some indication of corporate misfeasance, malfeasance, noncompliance, or incompetence. Instead, no matter what the issue under discussion, their knee-jerk reaction is, "All executives are crooks. There should be more money for the workers."

Remember the kid who cried wolf at every opportunity? When the wolf actually showed up, no one believed him.

That's my attitude toward these folks: not that their anguished cries are necessarily untrue, just that they're irrelevant. If the complaining class is going to bitch and moan and become belligerent and treat all corporate actions as if they were of equal importance, then it is not worth the resources required to sort through their routinized, recurring complaints to find out if one of them happens to be true.

As companies go down the tubes, the clamor rises for executives to return their huge paychecks, bonuses, stock options, and diamond-studded dog collars.

But the idea behind stock options is a good one, because they tie the interests of corporate executives to those of shareholders. Crap like we're seeing now in the marketplace is caused by slick, unethical, or dishonest executives seeking to manipulate the system for their personal advantage. Damn the consequences, fill my personal coffers.

Fine. Take it all away and give them 20 years to think about it. I'll be the first one to vote to convict.

It's Disappointingly Small

The mostly meaningless idea of CEOs giving back a portion of their pay is growing in popularity. It would be a good symbolic gesture, of course, and if it indicated an ethical stand, that would be a good start, but, in the context of pension funds and lost jobs of thousands of employees, the enormous-sounding millions of dollars turn out to be a few months' rent. Not nothing, mind you, but disappointingly small in comparison with a lost salary or pension fund.

Let's take Enron as an example. In February, CornerBarPR.com listed assets and stock sales of former chairman Kenneth Lay in recent years at roughly $147 million. Some 6100 Enron employees lost their jobs and 18,000 employees and others lost money in pension fund investments. If Lay's entire compensation and bonuses for the past several years were divided among these folks, it would amount to only a paltry $6100 per person affected.

Now if someone were to hand me a check for that much money, it would seem like a lot at the moment, but the only people who would get checks would be the employees. Many of the folks with retirement accounts would see very little change in their ultimate retirement benefit.

Of course, it is completely reasonable to demand that Lay and Ebbers and dishonest executives everywhere not profit from questionable or dishonest accounting, but, in terms of making things right for those directly affected -- not to mention thousands more shareholders -- returning their pay would have a fairly small impact.

Are there arguments for changing reward structures so the executives are bonused for doing the right things?

Sure. Absolutely. Emphatically.

Mine Is Bigger Than Yours

But the penis envy of someone having a bigger ... salary ... and you want one like it, or, at least, a part of it, has neither legal nor, in my mind, moral standing. It's just another form of class warfare.

In the U.S., we have a trio of old-fashioned, time-honored ways of dealing with dishonesty: Regulatory action, criminal sanctions, and the private lawsuit.

If you think that regulators are toothless and criminal prosecutors ignore corporate leaders, ask the executives of Enron or Merrill Lynch or Arthur Anderson. Justice may grind slowly, but it grinds exceedingly fine.

And lawsuits?

If their gains are ill-gotten, drag 'em through the courts. And when they lose, they'll pay losses, damages, penalties, and, in particularly egregious cases, your expensive lawyers' fees as well as their own. Prison may be in their futures, but once you've given up the penthouse, what difference does that make?

Paid to Perform

Let's talk about the innocent bystander for a moment. If there is no misfeasance or malfeasance, why should a CEO who is rewarded for performance in the previous year have that prior year's income penalized for failures in the current year?

When a halfback gets a performance bonus for logging a million yards and thousands of touchdowns, we don't ask for it back because his hands have become greasy and his legs turned to rubber this year. The baseball player who receives an incentive for destroying the outfield lighting in stadiums all across the league doesn't have to return the money because his home run production falls off.

No matter how popular this chorus of "give up your bonus" becomes, it is based on a terrible idea. At least it is for every company and executive that honestly succeeded, then fell on hard times through no particular fault of their own.

Let me give one example. Richard Green, Jr., chairman of dwindling utility and energy trading company Aquila, Inc., formerly UtiliCorp United, received $10.3 million in pay for last year, based on the company's performance in 2001, when things were going well. His brother, Robert Green, Aquila CEO, received a bonus of nearly $8 million.

In the past few months, Aquila has laid off more than 1000 employees and plans to shut down its energy trading operation; the company's stock has fallen to record lows. In an act of timing that either was blatantly stupid or an incredibly unfriendly coincidence, the company gave roughly $30 million in bonuses to executives -- based on the previous year's results -- about a month before 500 employees lost their jobs in the first set of layoffs.

It's a Scandal

The media have tried to link the cutbacks to the "scandalous" payment of senior executives, as if either Aquila cut staff in order to afford to pay big executive bonuses or, if they hadn't paid the bonuses, the company wouldn't have had to disrupt the lives of 500 workers. Neither is correct.

But the majority of Richard Green's pay not only was tied to 2001 performance, he apparently took most of it in restricted company stock. Thus, he lost half of the $10 million in a matter of weeks, as the market voiced its revised opinion of the company's value (down about 70 percent in the past year).

Is CEO and Chairman's pay tied to stock performance? You bet! Will either man get a bonus for 2002? No way!! And part of the $30 million in executive bonuses was reward for their roles in achieving a successful IPO of an Aquila subsidiary in 2001, which raised $446 million.

Did reporters want to hear all that? No, it doesn't fit their pre-conceived story. They know the man on the street doesn't earn even six figures, much less seven or eight, so whipping up a frenzy of envy and disgust would be an easy kill.

And why not toss in a reference to mob bosses and indicted criminals in a neighboring paragraph to get a little rub-off there, as well? It's a great case study in media demagoguery, and, for those smeared, there is no defense or explanation that will get any sympathy (other than from fellow CEOs, perhaps).

Here's the key question: Was Aquila poorly run? If so, then the Board should reclaim or give up its bonuses. Or did it fall victim to an overall decline in energy prices, exacerbated incalculably by the effect the Enron Corp. bankruptcy had on the entire sector?

All Tied Up, With No Means of Escape

If Richard Green and Robert Green ran the business well, why should their bonuses be tied to dishonesty at Enron, unless they knew about it in advance?

Now I merely use this as an example. I don't know Richard Green or Robert Green, and I don't know what evildoing may yet be uncovered at Aquila. But for me, it is the principle that is important, not the facts of this particular business.

One local columnist wrote that these executives were "irrationally and exuberantly compensated." Really? Perhaps, if they were dishonest or bad managers. But not if they're falling victim to failings over which they had neither control nor predictive ability. I'm not willing to say these guys are bad simply because they got big bonuses and then did what was necessary to save their company when it fell on hard times.

That's just piling on, and it is unseemly.

Of course the good news is that, out of what will be many personal and financial tragedies, we will get some needed reforms -- after all the caterwauling and finger-pointing and self-serving political hand-wringing has subsided and

responsible parties try to avoid the overreaction that seems to be our journalists' and elected leaders' standard response to any ill and actually make thoughtful changes.

But we shouldn't assume that everyone who has bad results is a crook.

[For the record, Brenda was an investor in UtiliCorp. She got out after their stock started tanking.]